Liquid Staking Tokens (LSTs) are transforming the decentralized finance (DeFi) landscape by combining staking rewards with liquidity. This article explores how LSTs are changing the game for crypto investors, providing new opportunities, and enhancing blockchain networks.

👀 What Are LSTs?

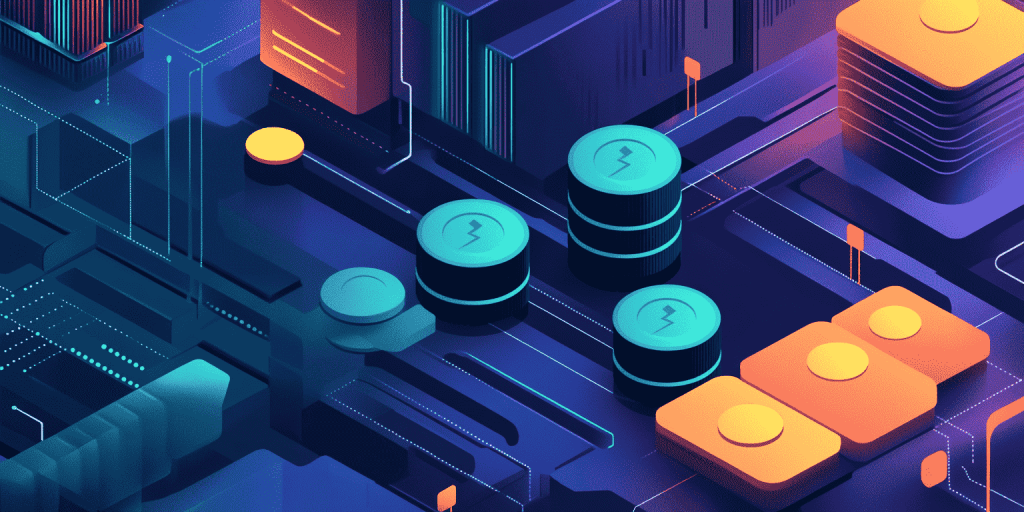

Liquid Staking Tokens (LSTs) are financial instruments within the DeFi ecosystem that allow users to stake their assets while maintaining liquidity. Traditionally, staking involves locking up tokens to support network operations and earn rewards, but this process limits access to the staked assets. LSTs, however, enable investors to stake their tokens and receive a tokenized representation of the staked assets, which can be freely traded or used within other DeFi applications.

⚖️ How Do LSTs Differ from Traditional Staking?

Traditional staking mechanisms require investors to lock up their assets for a specified period, during which they cannot access or use the staked tokens. This lockup period can be a significant limitation, especially in a volatile market where liquidity is crucial. In contrast, LSTs offer a solution to this problem by allowing staked assets to remain liquid, thus providing more flexibility and opportunities for investors.

🔑 Key Features of LSTs

- Maintain liquidity while earning staking rewards: LSTs allow users to stake their assets without losing access to them.

- Increased flexibility: Investors can trade, lend, or use their liquid staked assets in various DeFi protocols.

- Enhanced participation: By providing liquidity, LSTs encourage more users to participate in staking and other DeFi activities.

- Improved security: Staked assets contribute to network security while remaining liquid.

🌎 Real-World Examples

Several projects have successfully implemented LSTs to provide flexibility for DeFi participants:

- Lido Finance: Lido Finance allows users to stake Ethereum (ETH) and receive stETH, a liquid token that represents staked ETH.

- Rocket Pool and Ankr: They offer liquid staking solutions for various blockchain networks.

🚀 Advantages

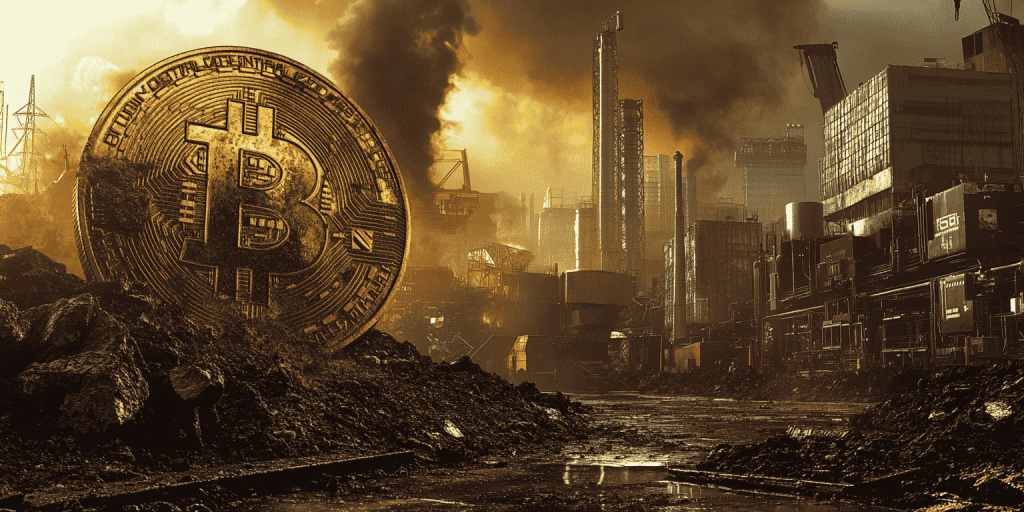

Increased DeFi Participation

LSTs significantly boost participation in the DeFi ecosystem by providing a way to earn staking rewards without locking up assets. This accessibility encourages more users to engage with various DeFi protocols, expanding the user base and increasing market activity.

Enhanced Portfolio Performance

By allowing assets to remain liquid, LSTs enable investors to diversify their portfolios and participate in various DeFi opportunities without compromising on staking rewards. This flexibility leads to improved portfolio performance and the ability to adapt quickly to market changes.

Long-Term Potential and Growth

The long-term potential of Liquid Staking Tokens (LSTs) in the DeFi space is immense. As more investors recognize the benefits of maintaining liquidity while earning staking rewards, the adoption of LSTs is expected to grow significantly. This growth will likely lead to the development of more sophisticated financial products and services, further integrating LSTs into the broader DeFi ecosystem. The versatility and utility of LSTs position them as a key component in the future of decentralized finance.

✍️ Conclusion

Liquid Staking Tokens (LSTs) are revolutionizing the DeFi landscape by combining staking rewards with liquidity. They offer numerous benefits, including increased flexibility, enhanced participation, improved security, and the potential for significant financial innovation. By addressing challenges and fostering a secure and fair ecosystem, LSTs can unlock new opportunities and drive the future of decentralized finance.

❓ FAQs

What are Liquid Staking Tokens (LSTs)?

Liquid Staking Tokens (LSTs) are financial instruments that allow users to stake their assets while maintaining liquidity. They provide a tokenized representation of the staked assets, which can be freely traded or used within other DeFi applications.

How do LSTs differ from traditional staking?

Traditional staking requires investors to lock up their assets for a specified period, limiting access to the staked tokens. LSTs overcome this limitation by allowing staked assets to remain liquid, providing more flexibility and opportunities for investors.

What benefits do LSTs offer to DeFi participants?

LSTs offer several benefits, including the ability to earn staking rewards while maintaining liquidity, increased flexibility, enhanced participation in DeFi protocols, and improved portfolio performance.

How do LSTs contribute to blockchain security?

LSTs contribute to blockchain security by ensuring that a significant portion of tokens remains staked, supporting network security. At the same time, they provide liquidity, encouraging more active participation in the ecosystem.

What is the long-term potential of LSTs?

LSTs have immense long-term potential in DeFi, with expected growth in adoption leading to more sophisticated financial products and services. They are positioned as a key component in the future of decentralized finance.

Leave a comment