The intersection of blockchain technology and traditional finance has brought about a revolutionary concept: the tokenization of real-world assets (RWAs). By bringing tangible assets onto the blockchain, tokenization offers unprecedented levels of transparency, efficiency, and accessibility. This article explores the intricacies of RWA tokenization, its benefits, challenges, and its transformative potential in the financial landscape.

🏠 What Are Real-World Assets?

Real-world assets refer to tangible items that exist outside the digital spectrum, such as real estate, commodities, or even intellectual property. These assets can be tokenized, enabling them to be represented digitally on the blockchain.

🪙 The Rise of RWA Tokenization

The process of RWA tokenization is gaining traction, driven by institutional adoption and advancements in decentralized infrastructures like identity verification and oracle services. This movement is expected to continue, offering more streamlined and transparent asset management solutions.

🔁 Tokenization Process

- Identify Valuable Assets: Determine which physical or digital assets to tokenize.

- Regulatory Approval: Seek necessary legal permissions to tokenize and trade these assets.

- Select Blockchain Network: Choose a blockchain platform for creating and issuing tokens.

- Create and Issue Tokens: Develop tokens representing the assets and distribute them.

- Facilitate Trading: Enable token trading on decentralized platforms.

🏙️ Real-World Applications of Tokenized Assets

- Real Estate: In June 2019, the first tokenization of real estate in France marked a significant milestone. Similar initiatives, like a luxury resort in Aspen raising $18 million through a security token offering (STO), showcase the potential in this sector.

- Fractional Ownership: Tokenizing illiquid assets like commercial buildings allows for fractional ownership, enabling easier trading and transfer of asset portions.

- Credit Markets: On-chain credit protocols have emerged, allowing businesses to tap into DeFi ecosystems for capital, with private credit protocols managing substantial loan values.

➕ Benefits of Tokenizing Real-World Assets

- Enhanced Liquidity: Tokenization allows for fractional ownership, making it easier to buy and sell portions of high-value assets.

- Transparency: Blockchain’s immutable ledger ensures that all transactions are visible and verifiable.

- Accessibility: A broader range of investors can engage with previously out-of-reach assets, democratizing investment opportunities.

- Efficiency: The use of smart contracts automates and expedites transactions, reducing the need for intermediaries.

➖ Challenges in RWA Tokenization

- Regulatory Hurdles: Navigating the legal landscape for tokenized assets is complex and varies by jurisdiction.

- Security Issues: Ensuring the security of digital tokens against cyber threats is paramount.

- Market Acceptance: Gaining widespread trust and adoption for tokenized assets requires time and proven reliability.

🔑 Key Players in the RWA Space

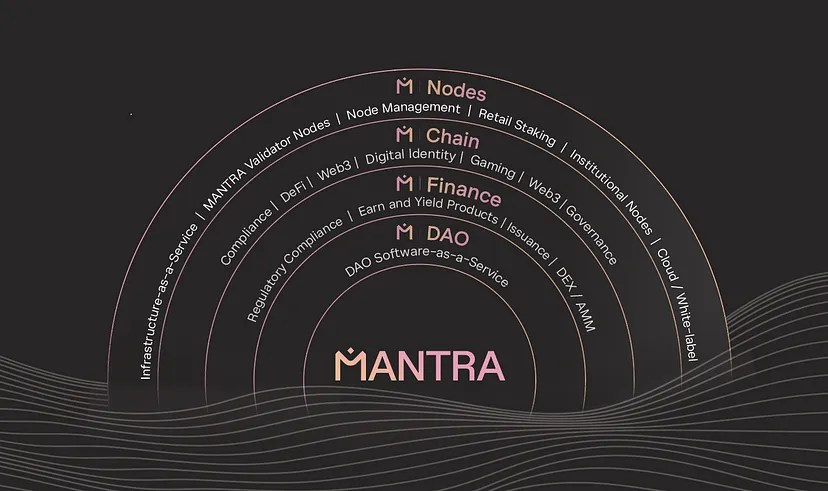

Several leading crypto projects are pioneering the tokenization of Real World Assets (RWAs), including Ondo Finance, Mantra, Polymesh, OriginTrail, TokenFi, Securitize, and Untangled Finance. Ondo Finance offers a platform for tokenizing assets like US Treasuries, enhancing liquidity in DeFi markets, while Mantra focuses on creating regulatory-compliant infrastructure for RWA tokenization, particularly in the Middle East and Asia.

🚀 The Future of Real-World Assets in Crypto

The tokenization of real-world assets is a growing trend that promises to reshape the financial landscape. As blockchain technology continues to evolve, RWAs will likely play an integral role in various applications, from lending and borrowing platforms to asset management and index funds. The continued development of decentralized identity and oracle services will further bolster the integration of physical and digital asset ecosystems.

By enhancing liquidity, transparency, and accessibility, RWA tokenization offers a glimpse into the future of finance, where the boundaries between the physical and digital worlds are increasingly blurred.

Leave a comment