At the recent ETHCC conference in Brussels, there was a lot of debate on whether the focus should be on developing the foundational blockchain infrastructure or creating applications that cater directly to end-users. Is too much being invested in infra at the expense of apps that can serve the general public?

Investments in blockchain infrastructure have historically offered impressive returns. Notable projects in this space have recorded growth rates surpassing 800% over the last five years and dramatically outperforming traditional financial indices. This track record has spurred continued inflows into the sector, with recent significant funding rounds aimed at enhancing the capabilities of foundational blockchain technologies.

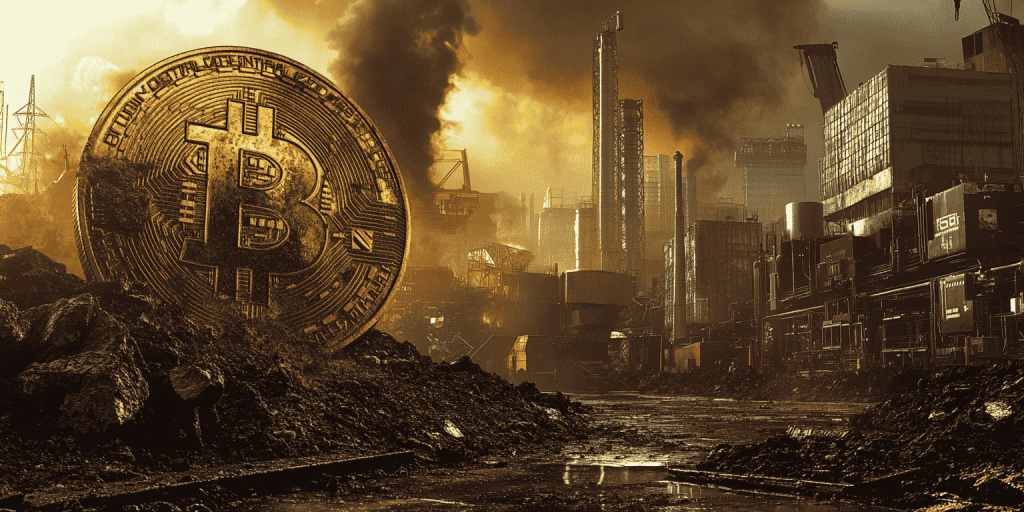

Despite substantial investments in infrastructure, the broader crypto market still faces challenges in developing applications with long-term viability and widespread adoption. The primary successes in the realm of end-user applications remain focused on established functionalities such as cryptocurrency as a digital store of value, payment solutions through stablecoins, and various speculative trading platforms—functions that existed before the surge of capital into infrastructure development.

Supporters of further infrastructure investment believe that a strong technological base is crucial for the crypto applications to compete against existing digital platforms. In contrast, those in favor of focusing on application development argue that the infrastructure is already overbuilt and underutilized. They suggest that the redirection of resources towards innovative application development could foster more practical and engaging user experiences.

This ongoing debate highlights several key barriers to the development and successful market introduction of crypto applications. One perspective suggests that the applications can be divided into two primary categories: those that decentralize existing digital services and entirely new services that leverage unique capabilities of blockchain technology. Successful applications in these categories could validate the effectiveness of current infrastructures, like those enabling scalable social media platforms on the blockchain, which have shown significant user growth in recent times. However, more advanced applications, such as those in decentralized gaming, continue to face hurdles due to infrastructure limitations.

Another viewpoint focuses on the challenges related to market demand and consumer adoption. The path for infrastructure projects is relatively straightforward—improve transaction speeds, reduce costs, and maintain a degree of decentralization. However, developers of end-user applications must navigate the uncertain waters of consumer demand, which is less predictable and can vary widely between different market segments.

Operational difficulties also pose significant challenges, particularly in deploying and updating features in a blockchain environment. For instance, updating smart contracts often requires users to transfer assets, potentially leading to a poor user experience. Moreover, promotional campaigns designed to boost user engagement can sometimes result in skewed data, complicating the assessment of genuine interest and value in the application.

Ultimately, the development of both robust infrastructure and innovative applications is essential for the sustained growth and maturation of the cryptocurrency sector. While infrastructure lays the groundwork necessary for high-performance applications, innovative apps are crucial for driving user engagement and demonstrating the practical value of blockchain technology. A strategic focus that balances infrastructure development with application innovation may provide the most effective route forward, encouraging both sector growth and technological advancement.

Leave a comment